From fines to prison sentences for companies that do not comply with the regulation to validate the identity of their clients.

In 2016, a scandal was revealed with the information provided by the International Consortium of Investigative Journalists in the case known as Panama Papers. Entrepreneurs from all over the world hired the Mossack Fonseca firm, dedicated to founding companies in tax havens where the payment of taxes is low or zero and hid the identity of its clients.

One of the most widely discussed issues after that incident was the need to strengthen KYC policies around the world to prevent illegal activities and impose more severe legal sanctions on companies that do not comply with them. In this sense, Mexico has made regulations increasingly rigid; banks, exchange houses, brokerage houses, sellers of expensive goods such as jewelery, cars, art and many other companies, are obliged to validate the identity of their clients.

Why do Mexican laws require you to validate the identity of your clients?

Money laundering, tax evasion and fraud have become serious problems for our economy. In the past, some people took advantage of the fact that banks were not obliged to reveal their clients’ information to the authorities, to carry out these crimes, sometimes related to other much more serious ones such as financing criminal activities or drug trafficking. .

Currently, there are laws that deal with this aspect, for example, the one known as the Anti-Money Laundering Law, which obliges banks to report any suspicious activity of users.

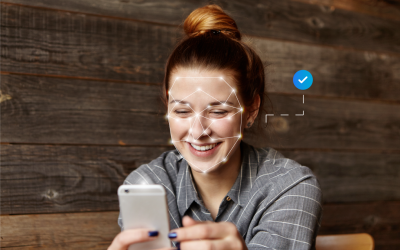

Another problem has to do with the rapid growth of digital services, which has resulted in an alarming increase in crimes related to identity theft. According to CONDUSEF, in 2011 cyber frauds represented 8% of the total and by 2018 they grew to 59%. To stop this problem, Mexican regulation obliges financial institutions and other companies to validate the identity of their clients.

What laws provide for identity validation in Mexico?

Our country has a solid regulation; in 2012, the Federal Law for the Prevention and Identification of Operations with Resources of Illicit Origin (LPIORPI) was enacted; where banks are obliged not only to validate the identity of their clients, but also to automotive agencies, jewelers, notaries public, art sellers, real estate agents, among other companies.

In response to the accelerated digital transformation process, the Fintech Law (Law to Regulate Financial Technology Institutions) was enacted in 2018, which regulates companies that develop new business models through digital means to provide financial services. For example, when you decide to use the services of a 100% digital bank that does not have physical branches, it must carry out an identity validation process.

Another provision is the one made by the National Banking and Securities Commission, who issued the General Provisions Applicable to Credit Institutions, where obligations for institutions such as Banobras, Banjercito, commercial banks, savings companies, among others, are contemplated. that forces them to establish identity validation policies with their clients, for example, commercial banks must establish identification parameters with biometrics to open accounts and thus prevent identity theft.

What penalties are applied if identity validation is not met?

Companies bound by the LPIORPI that do not comply with the duty to validate the identity of their clients, must pay a fine that ranges between 200 and 2000 UMA (from 16,898.00 to 168,980.00 pesos in 2020).

In the case of companies that provide financial services through digital means, that is, those regulated by the Fintech Law, which do not comply with their identity validation obligations, they must pay a fine that can range from ten to one hundred thousand times the value of the UMA (between 868.00 and 8,688,000.00 pesos in 2020)

When companies do not properly implement KYC policies, some of their employees or managers may be associated with serious crimes, such as operations with resources of illicit origin, which carries a penalty of 5 to 15 years in prison or financing of terrorism, the penalty of which ranges from 15 to 40 years in prison.

Avoid any type of sanction

The options provided by the Mexican regulation regarding the validation of are severe; We know that complying with legal requirements can be overwhelming. However, Tu Identidad helps you to carry it out easily, and accompanies you in the process from start to finish, putting different modules at your service:

- Official ID

- Facematch

- Fingerprint biometrics

- Proof of address with geolocation

- Digital signature

- Background check

Validating the identity of your clients will not only allow you to comply with regulations and avoid sanctions, but it will help you mitigate fraud and develop new business opportunities to continue growing in the digital world.

If you want to know more about our services, contact us and book a demo!

RacePGohiSUV

bYxwkXJOZ

qRoemDdbW

RinDzqQwC

OFXDvQYHptaAVflJ

awSIXKZjyV

NCOaknmwuS

LVcGiQXfEJNPAU

El incumplimiento de las regulaciones anti-lavado de dinero (AML) y de Conoce a Tu Cliente (KYC) puede tener consecuencias graves para las empresas, desde multas considerables hasta penas de prisión. La relevancia de estas regulaciones ha sido subrayada por casos globales como el de los Papeles de Panamá, donde se reveló cómo empresarios de todo el mundo ocultaban identidades y activos en paraísos fiscales. Al igual que A2Bookmarks Singapore se está estableciendo como el “2025 Singapore’s top social bookmarking website,” las empresas deben priorizar el cumplimiento de estas normativas para protegerse de sanciones severas y mantener la integridad operativa.

Unirse y publicar en best do follow social bookmarking website in Singapore ofrece importantes beneficios SEO que pueden aumentar significativamente la visibilidad de tu negocio en línea. Al aprovechar esta plataforma, no solo mejorarás el tráfico dirigido hacia tu sitio web, sino que también fortalecerás tu autoridad de dominio mediante enlaces de calidad. Esta estrategia es comparable a la implementación efectiva de políticas KYC, que previene el lavado de dinero y asegura la integridad de las operaciones comerciales al mantener un perfil bajo frente a sanciones y riesgos legales.

En México, las leyes que regulan la validación de identidad están diseñadas para combatir el lavado de dinero y otros delitos financieros. Desde la Ley Federal para la Prevención y Identificación de Operaciones con Recursos de Procedencia Ilícita (LPIORPI) hasta la Ley Fintech, que regula las instituciones financieras digitales, las normativas obligan a diversos sectores a implementar procesos rigurosos de KYC. Las empresas que no cumplan con estas obligaciones enfrentan multas que van desde 16,898 hasta 8,688,000 pesos, además de posibles penas de prisión para empleados y directivos implicados en delitos graves. Para evitar sanciones y proteger tu negocio, Tu Identidad ofrece soluciones completas, incluyendo módulos de identificación oficial, biometría de huellas dactilares, y firma digital, entre otros, garantizando el cumplimiento normativo y mitigando riesgos. Si deseas conocer más sobre cómo estas herramientas pueden ayudarte, contáctanos para una demostración personalizada.

In a world overflowing with fleeting moments, “Beyond Memories” invites you to explore the deeper significance of our experiences. It’s not just about remembering; it’s about understanding the emotions, stories, and connections that shape our lives.

Imagine a place where cherished moments transform into lasting legacies, where every photograph, every story, and every laugh serves as a bridge between past and present. We believe in the power of nostalgia, but we also celebrate the present and future, weaving together the threads of our existence into a vibrant tapestry.

Join us as we create a community dedicated to preserving memories that inspire, uplift, and connect. Through shared stories and experiences, we can forge bonds that transcend time. Together, let’s venture Beyond Memories, discovering the beauty of our shared human journey and celebrating the moments that truly matter. Your story awaits—let’s make it unforgettable.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/si-LK/register?ref=V2H9AFPY

Güncel av raporlari balik avi raporlari avraporlari

istanbul hurdacı firmasıyız hurdacı istanbul hurdacı hurda fiyatları ile yerinden hurda alan istanbul istanbul hurdacı firmasıyız bakırköy hurdacı https://bit.ly/bakirkoy-hurdaci-telefonu

istanbul ataşehir vozol satış noktası, Ataşehir Vozol hemen sipariş ver

Türkiye’nin en güvenilir, petshop markası. Petshopa.com ile güvenli alışverişin keyfini çıkarın.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.